|

|

|

|

|

|

|

|

|

|||

|

|

|

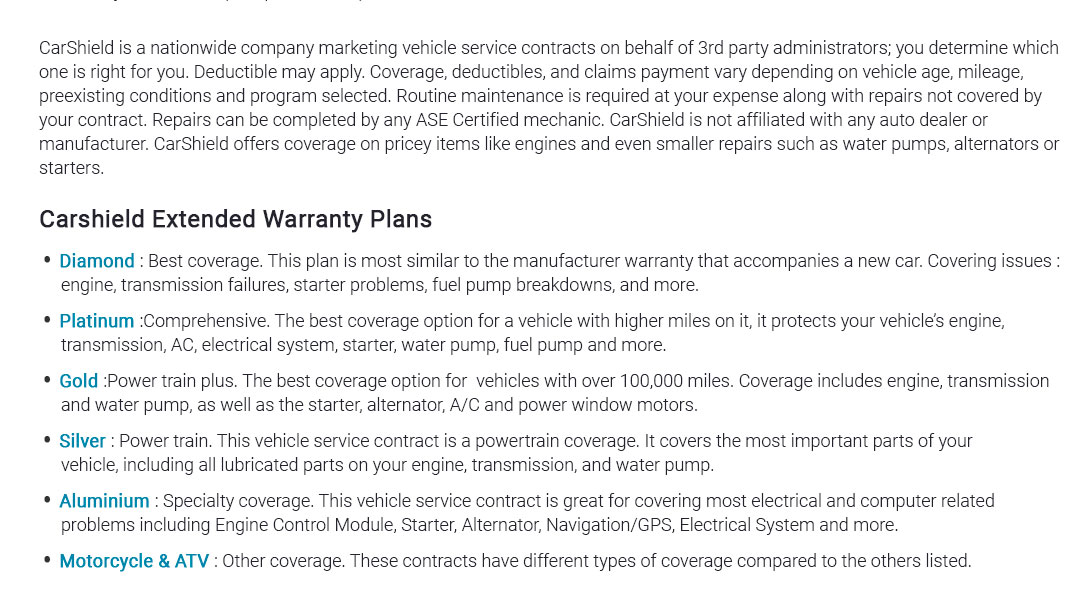

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

car repair insurance quotes made clearWhat these quotes meanA quote estimates what you'll pay for coverage that helps with unexpected mechanical repairs. It is not liability or collision insurance. It's a price for a defined set of repair protections, time limits, and rules. Read the parts list, the exclusions, and the claims steps, not just the monthly number. Who might benefit

Key variables shaping a quote

Accessibility mattersI look for plain-language summaries, readable PDFs, large-type options, and support hours that match my schedule. If I can't reach a person or get an answer in simple terms, I assume claims might be harder than sales. Reading the offerOver lunch, I request three car repair insurance quotes on my phone. One is cheap but has a $500 deductible and strict pre-approval. Another includes roadside help and rental coverage. A third touts a "limited-time" price - I pause; urgency can wait (yes, the countdown clock again). I compare not just price, but what happens on a bad Tuesday when the alternator fails. Cost levers you control

How to compare quotes

Red flags to slow down for

Small glossary

Quick checklist before you accept an offer

FAQIs this the same as an extended warranty?Not exactly. Some policies are insurance-backed, others are service contracts. Focus on who pays, what's covered, and how claims work - labels vary. Will a claim raise my auto insurance rate?Often it's a separate product, but data can be shared. Check the provider's policy on reporting and renewals. Can I choose my repair shop?Sometimes. Network shops can be smoother; out-of-network may need extra steps or different reimbursement. Can I cancel?Usually, with possible fees and prorated refunds. Confirm the exact terms in writing. Keep it simple: accessible documents, fair offers, and a total cost that makes sense. If it adds clarity and protects your budget, good. If not, pass - no fear of missing out. https://www.marketwatch.com/insurance-services/auto-insurance/auto-repair-insurance/

Auto repair insurance policies can cost as little as $30 to as much as $100 per year. But if budgeting for this type of insurance, you should ... https://www.esurance.com/

Start a fast, free auto insurance quote with Esurance. We help you find car insurance coverages that are right for you, so you're not paying for anything ... https://www.mercuryinsurance.com/insurance/auto/

Most states require minimum liability coverage, which includes: Medical expenses for other drivers and passengers; Repairs for other vehicles or property you ...

|